Driving Financial Excellence Through Diverse Expertise

With nearly two decades of experience across diverse industries, FinFocus Consulting brings a purpose-driven approach to financial consulting. Our expertise in strategic finance, process optimization, and investment analysis allows us to craft customized, impactful solutions that help businesses not only survive but thrive. Here’s how our skills can empower your business:

Our Key Skills and Capabilities

1. Strategic Financial Leadership

Growth and Expansion Planning

Our actionable insights support long-term growth, from building five-year financial roadmaps to validating new product lines. We guide clients to make confident, data-backed decisions that align with their strategic vision.

Commercial Viability Assessments

Leveraging financial modeling and scenario analysis, we offer robust validation for new ventures, ensuring each decision supports your long-term business objectives and competitive edge.

2. Financial Planning & Analysis

Budgeting and Forecasting

Our streamlined budgeting and forecasting bring clarity and control, even within complex, multi-department organizations.

Cash Flow Management

Through proactive cash flow monitoring systems, we help clients maintain stability through seasonal changes or rapid expansion, minimizing financial risks and enhancing readiness.

3. Process Improvement and Change Management

Optimizing Financial Reporting

Our team refines financial reporting processes to ensure accuracy and clarity. From dashboards to KPI tracking, our improvements enhance decision-making with greater transparency.

Leading Change Initiatives

Whether restructuring processes or upgrading systems, we guide clients through seamless transitions, supporting organizational change with clarity and measurable impact.

4. Investment Analysis and Portfolio Support

Investment Deck Development

We develop high-quality, investor-ready models, scenario analyses, and presentations that instill confidence and attract potential investors.

Cost Optimization and Financial Turnaround

Specializing in cost-cutting and profitability strategies, we help clients build resilience through actionable plans that restore and enhance cash flow.

Where We Connect You to Additional Expert Resources

While we excel in strategic financial consulting, we also value the importance of specialized expertise. For areas outside our scope, we refer clients to trusted professionals:

Routine Accounting

We focus on strategic consulting rather than day-to-day accounting. For bookkeeping or payroll, we recommend qualified accountants.

Tax Advisory and Compliance

Tax services fall outside our expertise; we advise consulting specialized tax professionals.

Capital Raising and Fundraising

While we prepare clients for investor discussions, we do not directly handle capital sourcing but can refer you to fundraising specialists.

Audit Services

We do not conduct audits and recommend certified public accountants for assurance needs.

Legal Compliance

We do not manage statutory filings or legal formations but connect clients with legal experts for these needs.

Leveraging Extensive Experience in Top Companies

Drawing from nearly 20 years of extensive experience with a range of top-tier global organizations, we offer a wealth of knowledge and cutting-edge skill sets. This diverse background empowers us to deliver robust solutions tailored to meet the unique challenges our clients face, ensuring their success in an ever-evolving business landscape.

Playstation

Largest video gaming company, part of Sony, Fortune 500

Deliveroo

Multinational food delivery company, pre-IPO startup

Experian

Leading global consumer credit report company, FTSE100

FIS

Leading financial technology and payment company, Fortune500

Penguin Books

Largest global consumer publishing company, part of Pearson, FTSE100

British Telecom

Multinational telecommunications company, FTSE 100

KPMG

Global professional financial services firm, one of "Big Four"

King Games

Leading mobile gaming company, part of Microsoft, Fortune 500

Livenation

Largest global live entertainment companies, Fortune 500

Elevate your business with world-class expertise

FinFocus Consulting leverages on advanced qualifications from top academic institutions and professional certifications, equipping us to deliver exceptional financial consulting services by blending rigorous academic knowledge with practical, industry-leading practical skills in best-in-class financial systems and platforms.

Accounting Qualification

ACA (Associate Chartered Accountant) is a globally recognised certification by the Institute of Chartered Accountants in England and Wales

Project Management

PRINCE2 qualification is a globally recognized project management methodology that emphasizes a structured approach to managing projects

Business Degree

The MSc in Business Studies at the University of Bremen (Germany) focuses on advanced business and management concepts

Finance Degree

BSc in Banking and Finance at London School of Economics (United Kingdom) provides a strong foundation in financial theory and practice

Presentations / Slide decks

Extensive experience in creating high-quality pitch decks and investment presentations to showcase key financial metrics and insights

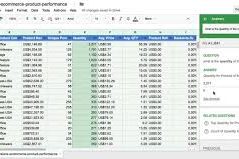

Financial Modelling

Advanced financial modeling, including use of macros and creating dashboards, using Microsoft Excel and Google Sheets

Financial Planning Systems

Extensive expertise in both using and implementing Financial Planning systems, including OneStream, Workday, Oracle and Anaplan

Business Intelligence

Extensive hands-on experience using and implementing BI platforms, including Tableau, MicroStrategy, Qlik, Power BI, Looker, and Salesforce

ERP Systems

Expert knowledge Enterprise Resource Platforms (ERP), including Oracle, SAP, Netsuite as well as client specific systems

Have questions? We’ve got answers!

Dive into our FAQs for quick insights on some common queries.

Ready to discuss how we can help your business thrive?

Contact us today to explore tailored financial solutions that fit your needs!

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.